JSW Steel, Tata Steel, Hindalco lead metals pack as Dollar Index slips

The sector gaugue, Nifty Metal index was trading at 5,955.25 and was up 2.46 per cent. Out of 15 stocks comprising the gauge, 11 were trading higher against 3 and one stock was unchanged

Metal stocks sustained gains in Thursday’s afternoon trade even as benchmark indices, Sensex and Nifty, were off the day’s high amid selling in IT, auto and FMCG sectors. The metals pack was led by JSW Steel, Tata Steel and Hindalco, still trading higher by up to 5 per cent.

The positive sentiment in the metals came as the Dollar Index (DXY) slipped below 110 against a basket of six major currencies.

The sector gaugue, Nifty Metal index was trading at 5,955.25 and was up 2.46 per cent. Out of 15 stocks comprising the gauge, 11 were trading higher against 3 and one stock was unchanged.

JSW Steel, Hindalco Industries and Tata Steel were leading the gainers. JSW Steel was trading at Rs 673.60 and was up 4.54 per cent. Hindalco was trading at Rs 410.50 and was higher by Rs 3.04 per cent around this time. Tata Steel was trading at Rs 104.20, up nearly per cent on the intraday basis.

Among sector watchers, Centrum Broking’s technical analyst Nilesh Jain is bullish on the sector in the near term and has picked Tata Steel and JSW Steel with buy recommendation, while takes a positional view on Hindalco.

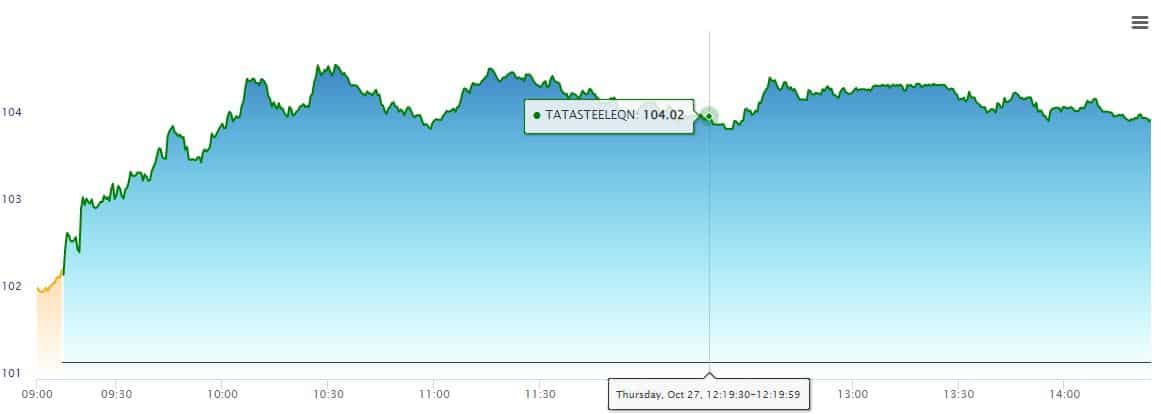

Tata Steel: Buy| LTP: Rs 104.20| Target: Rs 110 | Stop Loss: Rs 100| Upside 6%

Buying is recommended at current levels with a near term view, Jain said, while adding that the Tata Group steel stock has emerged from a falling channel trend line.

Source:NSE

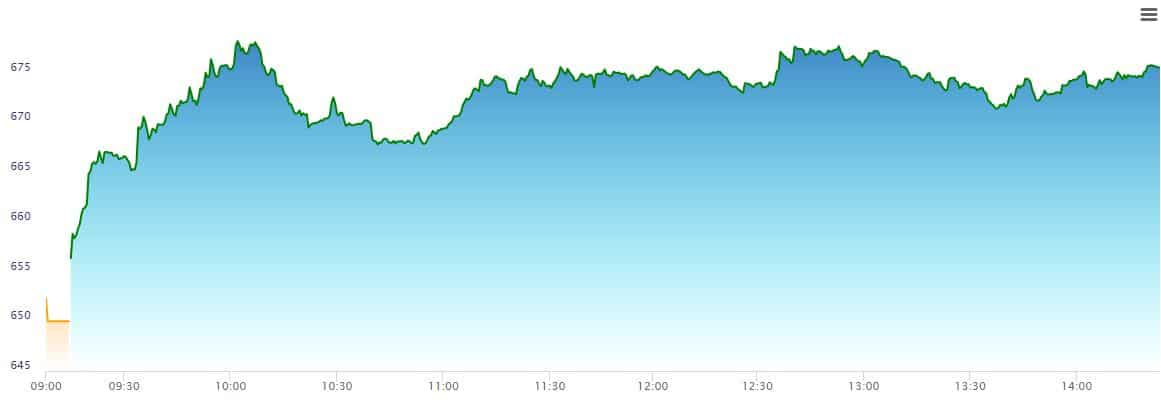

JSW Steel: Buy| LTP: Rs 672.10| Target: Rs 685-700 | Stop Loss: Rs 655| Upside 4%

The JSW Steel stock’s chart structure is similar to that of Tata Steel, Jain said. JSW Steel has so far seen a sharp rise in trade volumes with 63,10,737 shares changing hands at 2:30 PM.

Source:NSE

Hindalco Industries: Buy| LTP: Rs 410.45| Target: Rs 440 | Stop Loss: Rs 390| Upside 7%

A good bet in the non-ferrous space, as per Jain, Hindalco has so far seen a trading volume of 75,62,072 shares.

Joining Centrum’s Jain, market expert Sanjiv Bhasin of IIFL has also recommended buying the metals pack as the US Dollar may peak out soon. His top pick in metals is state-steel behemoth - SAIL.

Impact on auto sector:

Centrum’s Jain also said that the immediate traction in auto stocks could be attributed to weakness in USD. As movement of dollar is directly related to the commodity prices (barring bullion), the impact is being seen today. Any material impact will be seen only if low prices of commodity sustain.

Commodity and currency expert Anuj Gupta hopes a further correction in USD falling to 108-levels leading to a decline in commodity prices.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

RBI Rule: New system for online money transfers to be implemented from April 1, 2025; here's all you need to know

Katra-Srinagar Vande Bharat Train: Northern Railway announces train timings; check fare, route and other key details

03:06 PM IST

From Tata Steel to JSW Steel: Here's what analysts make of metal sectors stocks

From Tata Steel to JSW Steel: Here's what analysts make of metal sectors stocks This metal stock is up 32% in just 6 months, and counting; check out analysts' targets

This metal stock is up 32% in just 6 months, and counting; check out analysts' targets Should you buy, hold or sell Hindustan Copper shares? Multibagger PSU stock poised to almost double in 2 years, say analysts

Should you buy, hold or sell Hindustan Copper shares? Multibagger PSU stock poised to almost double in 2 years, say analysts Metal Sector Q4 Results Preview: Base metal firms likely to shine, steelmakers' margins may remain under pressure

Metal Sector Q4 Results Preview: Base metal firms likely to shine, steelmakers' margins may remain under pressure Hindalco Q1 results: Net profit falls 40% to Rs 2,454 crore, margin shrinks to 10.8%

Hindalco Q1 results: Net profit falls 40% to Rs 2,454 crore, margin shrinks to 10.8%